Photo: telegraph.co.uk

The main character of the developments of the economic crisis in Greece and the controversial decisions on the financial salvation of Cyprus is the banking system. In Greece, banks have become the living-dead because of public wastefulness. In Cyprus, it seems that all the people who have bank deposits will pay the bill. GRReporter presents the analysis of financial expert Kostis Lympouridis, which he published in his Facebook profile in the middle of last year. The analysis is still true today and contains the essence of the problem "banks vs economic crisis - who pays the bill...". Here is what Lympouridis says:

"Because populism thrives on the basis of ignorance, I would like to explain what is happening in the banking system; how it works, why it will be recapitalized and the alternatives that exist (or existed). If you were a cardiologist in 1989, a seismologist in 1999, a football coach in 2004 or an economist in 2010, you do not need this analysis. I humbly turn to the rest, hoping to provide answers to some questions.

Fig. 1

You see in Figure 1 a bank in the bud. The rectangle on the right shows the money available to the bank (investor funds and deposits). The rectangle on the left shows the money it lends.

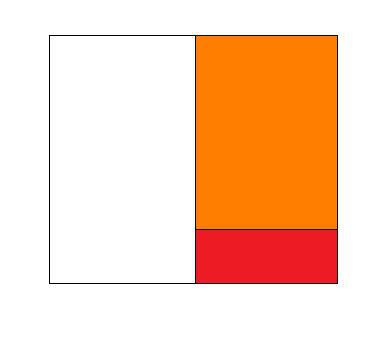

Fig. 2

You see in Figure 2 the bank that has been just established. Shareholders take out money from their pockets and create the equity. It is presented in red. There is nothing else yet.

Fig. 3

In Figure 3, the bank is already open and taking deposits. This is the orange colour and it presents the money deposited in a bank (payable to depositors) against an interest. Under the rules for the stability of the banking system, the money of shareholders cannot fall below a certain percentage of the total capital of the bank. To make it easy, let’s say that it cannot be less than 10% of deposits.

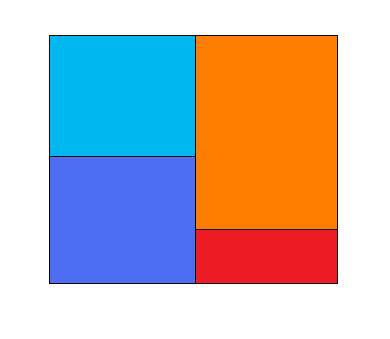

Fig.4

In Figure 4, the bank uses the money available (equity and deposits). You can see on the left what it did: the dark blue colour presents the money it invested in Greek government bonds and the light blue colour presents all of its loans (mortgages, consumer loans, credit cards, business loans, etc.).

This is the final version of the balance sheet of a bank. The profit of a bank is the difference between the money it receives on the left side minus the money it pays on the right side. Each bank has a different strategy, but all banks seek to maximize the revenue of the left area and to limit the spending of the right area.

The crisis that Greece has been going through over the last two years (the text was published in mid-2012) stems from the financial problems of the country. In particular, the spending in the state budget was higher than the revenue for many years. As a result, Greece announced in 2010 its inability to pay its foreign debt, i.e. to pay the bonds issued. The most recent development arising from this fact is called PSI or to put it plainly, the haircut of the nominal value of government bonds. This process implies that the owner of bonds with a value of 100 will change them for other bonds with a value of 47. So, the owner loses 53% of the initial capital invested in the bonds. The owner does it "voluntarily" or rather under the threat of losing everything otherwise, (the populist slogan erected by SYRIZA "complete debt forgiveness" or "denial of the total debt" by the Greek Communist Party KKE).

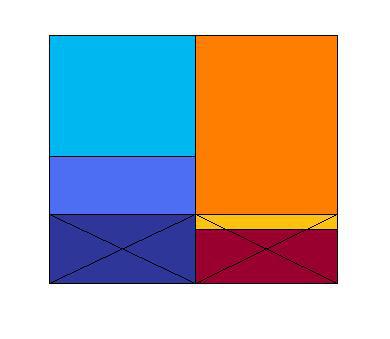

Fig. 5

Figure 5 shows the influence of PSI on the bank we are taking as an example. The PSI removes the dark blue part on the left that is the investment in Greek government bonds in the bank. Accordingly, it eliminates an equal part on the right. You should note that the amount must be written off from the money of shareholders (dark red) and this affects the yellow part of deposits.

So, here starts the whole talk about the "recapitalization of the banking system." How to find a way for capitals not just deposits to exist in the bank? At the same time, the deposits should not be less than investment and loans, that is ... are not to be withdrawn from the bank.

PSI provides that the state, which is only responsible for the collapse of the bank in our example, will secure the necessary funds. They are part of the money saved due to the haircut of the bonds issued.

When you hear the slogan, "bankers to pay the crisis," you can be sure that it is populism, because the bankers have already paid it. There is no bank in Greece at present whose resources have not vanished in the way previously described. The money the bankers had invested in the banks disappeared to compensate the haircut of the bonds held by financial institutions. The value of shares of all banks is zero. The peanuts, against which they are being traded on the stock exchange, are the hope of future profits rather than a present assessment.

The recapitalization cannot save the banks but deposits. This solution was preferred to avoid "haircutting" the deposits at the expense of bonds. Apparently, it was taken to save the credibility in the banking system and to keep the core belief of the post-war period that no one will lose money if he or she invests it in a Greek bank.