Picture: www.naftemporiki.gr

The Ministry of Development denied the possibility of legislation on cutting lending to companies and households. The working paper, published by the International Monetary Fund (IMF), which recommended cutting loans to companies and individuals in countries with financial difficulties, including Greece, triggered debates and representatives of the Ministry told Naftemporiki newspaper that such measures will not be taken, emphasising that the Ministry's opinion on settling loans, such as amendments to the Act on excessive household debts, remained unchanged. They stated that this report reflected the views of only two members of the Fund and, therefore, these were not binding for the government. Meanwhile, the Ministry of Development is awaiting the opinion of the Troika regarding last November's suggestions for the creation of a favourable regime for borrowers. The coming week, when the response of the Troika is expected, will be crucial for the future of these suggestions. The political leadership of the Ministry is prepared for a rejection and is seeking other opportunities.

The suggestion of the Ministry on facilitating borrowers in terms of requirements for mortgage loans, concerns employees and retirees from the private and public sectors, as well as those who have employment contracts with an annual family income of up to 25,000 euro, if this income has decreased more than 35% since 1 January 2010. It is suggested that loans related to the borrower's main residence, with a tax assessment of up to 180,000 euro, be granted a grace period of 4 years with a review in the second year. During this period, the borrower will pay only the interest, at a constant rate of 1.5%. If the amount of interest exceeds 30% of the taxable income, the monthly fee will be equalised with that percentage. In case of a zero income, the possibility of zero contributions is also provided, as well as an extension of the agreed loan period together with the duration of the grace period, and after the grace period expires, repayment of the loan will continue according to the initial contract.

The IMF's report recommended restructuring of liabilities of the private sector in the Eurozone countries most affected by the crisis that also include Greece. According to this working document, which noted that it did not reflect the official position of the IMF, after the years following the 2008 credit crisis, private debt levels, as a percentage of GDP, have increased significantly in European countries and, mainly, in Greece and Ireland. According to the report, households in these countries have experienced a significant decline in the value of property, which limits their ability to service their debts. If these problems are not resolved, high debt levels will continue to burden the private sector.

The Greek case

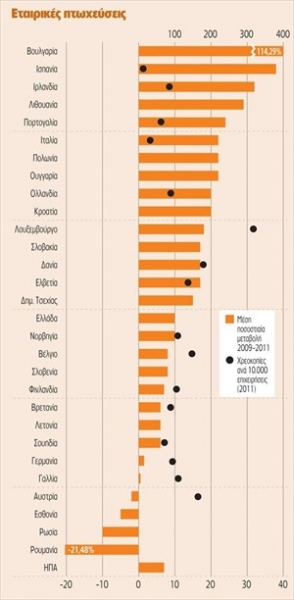

In the case of Greece and countries of the periphery (Italy, Portugal, Spain), recent data have shown that, in 2011, the percentage of cases of bankruptcy of companies marked a double-digit increase. The greatest number of bankrupt companies was reported in Bulgaria - for the period 2009-2011, these increased by 114.29%. This is followed, although from far off, by Spain and Ireland where the number of bankrupt companies increased by about 38% and 32% respectively. Greece is even further behind - bankrupt firms over the period increased by 10%. The situation is similar in the USA - the number of bankrupt companies there increased by about 7%. There is a slight change in France and Germany, where the increase was 1%-2%. In contrast, the numnber of bankrupt companies in Russia in the period 2009-2011 decreased by 10%. Among Balkan countries, Romania is following the most positive trend in this direction - bankruptcies there declined by as much as 21.48%.

The report also drew attention to over-indebted households and high levels of mortgage loans that made certain European countries implement special laws. The Katseli Act was also considered, as well as its basic provisions for the over-indebted who cannot apply for enrolment in the protection regime under the Greek Bankruptcy Code. The report also noted that the percentage of restructuring of household debt was very low and the creation of conditions for the restructuring thereof was absolutely necessary.

The working paper suggested that effective rules be established that would allow immediate cuts of liabilities of borrowers and noted that the law that is in force in Greece has not given the expected results. According to a statement of the finance department of SYRIZA, regarding the government's suggestions about the law on over-indebtedness, failure to handle high indebtedness of the private sector is helping neither debtors, nor creditors, and, in addition, well-reasoned regulations, aimed at the ease of households and firms, reduce uncertainty and have a positive effect on the economy as a whole. It is also pointed out that SYRIZA's suggestion of last October included the following main points: a full description of liabilities of borrowers who are below the poverty line, reduction of monthly contributions so that these do not exceed 30% of monthly incomes (the remaining 30% will be deleted). The government's bill, according to SYRIZA, did not suggest any substantial support to borrowers and small businesses, mainly because it applied only to employees and retirees. This favourable change excludes borrowers in small businesses - entrepreneurs whose companies are losing 80%-90% and are entangled in debt, and the only thing they want is to save at least their home.