It is expected that the opening, on Tuesday, of the tenders for the sale of the "Asteras" hotel complex in Vouliagmeni district, which is the largest transaction for the sale of a hotel in Greece, will show the interest in the productive investments that the country is already attracting.

After the funds that have recently entered Greece and that have been invested in stocks and bonds, the government's efforts in the next period will be aimed at attracting productive investments. In addition to the sale of "Asteras", it is planning to complete the transaction for the sale of the old airport in Athens by the end of the year The two major projects aim to create thousands of jobs and to contribute towards the economic recovery of the country. The development of the so-called Athens Riviera, or the beach extending from Neo Faliro to Vouliagmeni, will take place along with them.

According to well-informed sources, big investors from abroad, operating in the field of real estate and tourism worldwide, will submit binding offers in the tender for "Asteras". The majority of these international consortia will participate in the auction through joint ventures with Greek companies and some of them have already invested in the Greek market by participating, along with Greek companies, in the share capital of companies or projects, which shows not only that they do rely on, but also believe in, the economic recovery of the country.

It is expected that 4-5 joint ventures will take part in the tender unless something goes wrong. The offers, which will be submitted on Tuesday, will be evaluated in terms of the technical part first and then subsequently in terms of the financial conditions. Those participants who meet the requirements of the tender will be given the opportunity to improve their offer and submit "the best and final offer", and the Ministry of Finance hopes that the price will maximize.

As anticipated, the successful tenderer will be able to turn the hotel complex into a tourist destination where high-end holiday homes can be built. In this connection, some of the hotels in the complex may be demolished whereas others, or part of them, may be turned into holiday homes. All this means new jobs in the construction industry, which has suffered many blows due to the crisis, as well as in the tourism sector at a later stage.

At the same time, the fund for the use of state property is in a hurry to prepare the tender for the sale of the old Athens airport, aiming to complete it by the end of the year.

This is another big project in which two companies or more have expressed interest, including the Greek Lamda Development and the Israeli Elbit. It is not excluded that Qatar may express its interest as well. The marina in Alimos, which has been planned for the first quarter of 2014 and in which nearly 10 candidates have already expressed interest, will be next in line, followed by the sale of a plot near the Peace and Friendship Stadium, which includes the marina in Athens. The plans of the government involve the utilization of the Olympic facilities in the area, where the construction works of the Stavros Niarchos Cultural Centre are underway.

According to sources, the candidates who are interested in "Asteras" are as follows:

Colony Capital - Dolphin Capital: Colony Capital is a U.S. company with a global presence, related infrastructure in nine countries and with a powerful investment portfolio. A shareholder with a minority stake in the company that is involved in the tender is Dolphin Capital of businessman Kambouridis. Colony has invested in various projects, including "Atlantic City Hilton", "Las Vegas Hilton", "Raffles Hotels & Resorts", "Fairmont Hotels and Resorts", "Swisshotel" and "One & Only Hotels & Resorts".

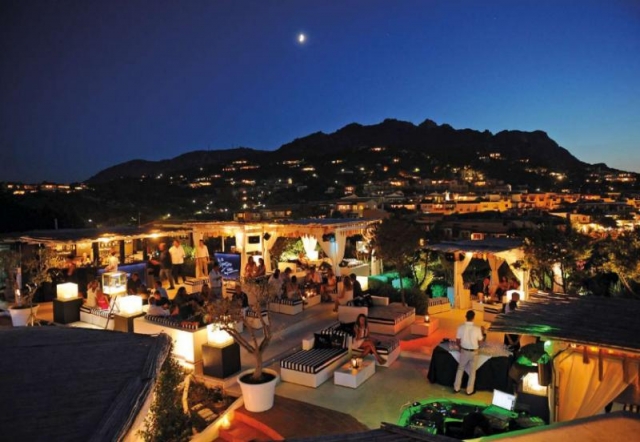

The company owns one of the most popular tourist destinations in the Mediterranean Sea area, namely "Costa Smeralda" in Sardinia.

Olayan Investments Company Establishment - Temes: Olayan Group is a global consortium involving, with a minority share, the company "Temes" of the Greek entrepreneur Ahileas Konstandakopoulous, owner of "Costa Navarino" in Messinia.

Olayan is one of the most demanded investors worldwide and has strategic participation in many world-famous companies such as Coca-Cola and banks like Credit Suisse and Morgan Stanley. The Group is a major investor in Chipita and has invested in many Greek companies in the past. Its relations with Greece are so strong that it maintains offices in Athens.

Fosun – Lamda Development: The Fosun consortium is the largest private business group in China. It is a first-class investor focused on the dynamic development of Asian countries. The company that is taking part in the tender involves, with a minority stake, Lamda Development owned by the Greek businessman Spiros Latsis. Fosun is based in China and it invests in countries around the world, trying to take advantage of the global opportunities. The company has recently announced that it has invested $ 1.6 billion in the construction of a hotel and casino in China, along with the Kerzner holding, as part of an investment project totalling $ 16 billion. In July, the company was approved to buy the French Club Mediterranee known as Club Med.

Fosun has already had a strong presence in Greece. In 2011 the company invested in the Folli Follie group and in 2013 one of its main subsidiaries, namely Fosun Pharma, signed a contract worth $ 500 million with the Greek - Swiss pharmaceutical and research Sellas Clinicals Holding for the development and sale of two medicines.

AGC: AGC is an investment holding company in the Middle East, based in London. It invests around the world by participating in the equity of private funds, investment companies, hedge funds and in companies investing in real estate, mainly in Europe and North America.

It takes part in investment projects in the field of real estate as well as in projects related to the property market. The capital of the holding mainly comes from the Middle East and particularly from companies based in Abu Dhabi, Kuwait and Saudi Arabia.

Dogus Holding: It is one of Turkey’s biggest holding companies with diversified business activities in the field of banking, construction and hospitality. It was unclear until Friday whether Dogus would participate in the tender individually or jointly with another company. It was said that it would cooperate with the AGC but this information was not confirmed. Dogus controls 18% of the marinas in Turkey and six marinas in Croatia.

In 2012 it set up a joint venture along with Lamda Development, part of Spiros Latsis’ holding, to invest in Greek marinas, including the port of Flisvos.