Simona Peneva

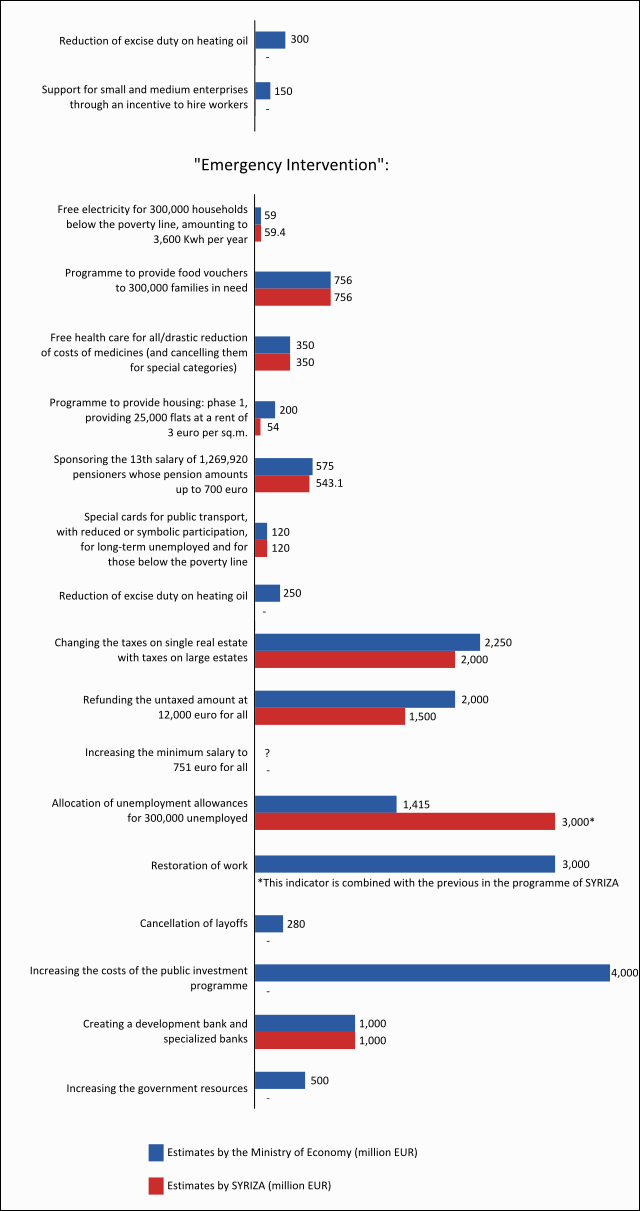

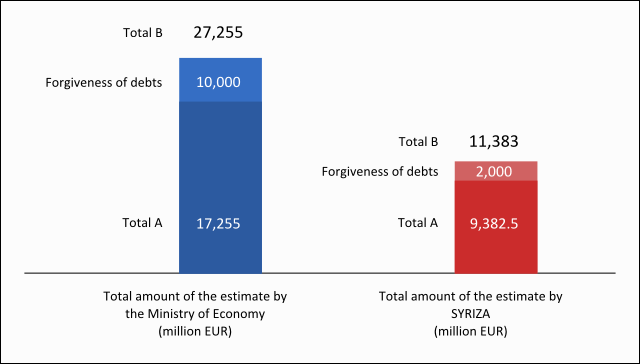

After a thorough examination the Hellenic Ministry of Finance announces that the economic programme of the largest opposition SYRIZA party will burden the state budget with 27.2 billion euro. The budget expenditures exceed the amount of 17.2 billion euro in the first year alone, without taking into account the private debt forgiveness declared by the opposition. SYRIZA confess to only 9.362 billion euro to which about 2 billion euro related to the cancellation of private debts must be added as well.

The Ministry describes the economic statements of opposition leader Alexis Tsipras as "perfunctory" as he announced that he would increase the public investment programme with 4 billion euro which he then failed to add to the budget expenditures. This 17.2 billion euro will increase the deficit by around 9% of GDP. By comparison, Greece currently has a primary budget surplus of 1.5%. In other words, according to the Ministry of Finance, the leadership of SYRIZA will lead Greece to a new fiscal crisis.

Also according to the financial institution, the cost of private debt write-off will not be 2 but 10 billion euro, and this is a conservative estimation. Therefore, the cost of SYRIZA governing, or the deficit, will be in the range of 15% of GDP. The Ministry of Finance clarifies that these calculations are minimal, since some of the proposed measures are so vague that it is not possible to calculate them with accuracy.

In addition to the effects on the budget deficit, the cancellation of the private sector debts has a direct financial cost too. It will increase the public debt by about 5-10% of GDP (10-20 billion euro), depending on the procedure that the write-off process will follow.

"All this leads to the conclusion that the economic proposals of SYRIZA are based on the wrong recipe and hamper the efforts to stabilize the economy. They do not solve the problems but create new ones, leading to the loss of confidence, a new loan with a high tax or to a new tax for the middle class, as well as to the deterioration of the financial system, capital flight from the country and a clash with our partners," concludes the Ministry of Finance. Even with the calculations of SYRIZA for budgeted expenditures amounting to at least 11.3 billion euro, Greece will seek funding from the markets and will pay high amounts in interests. The European Central Bank will stop the cheap financing to the Greek credit institutions and Greece’s partners will prevent the use of the funds from the National Strategic Reference Framework. Thus, according to the Ministry, there will again be rising unemployment and the young people will hurry to ensure their future abroad, which will lead to a deterioration in the country's prospects.

If the statements of SYRIZA are interpreted literally, meaning that the proposals are made within a balanced budget and without prospects for a loan, then the proposed measures will have to be compensated through increasing tax revenues by about 14 billion euro or by 2,700 euro per economic active citizen per year, again without taking into account the private sector debt write-off. Every attempt to impose excessive taxes will automatically lead to capital flight abroad and to even higher tax evasion. Even now just 0.5% of the population of Greece declare an income greater than 100,000 euro. Therefore, those who declare an annual income of 20,000-50,000 euro, or approximately 1.5 million taxpayers, will bear this brunt.

According to the Ministry of Finance, the economic programme of Alexis Tsipras contains a fundamental contradiction. While the sources of funding on which they rely will appear in the long run in the best-case scenario, the costs stipulated in the programme will appear in a direct manner. This will lead to an immediate shortage of funding and to the necessity of a loan, but a loan to carry out an expansionary fiscal policy is impossible. It is difficult to calculate the revenue from the apprehension of tax evaders and, in addition, some of the measures introduced by the programme contradict the purpose of apprehending tax evaders. Similarly, the estimates of the revenues from the regulation of the arrears and the redistribution of the funds from the National Strategic Reference Framework and the reserve of the Fund for Financial Stability are not documented.

The economic programme of SYRIZA requires funding and has additional, negative side effects on the development prospects of Greece, such as a sudden capital flight, increase in the value of household and business loans, freezing of privatization and new foreign investment, negative impact on the sustainability of the social security funds, it burdens the capital adequacy and the liquidity of banks, and leads to a loss of EU funds because of the clash with the European Union. "The recent efforts of the state to achieve economic recovery will be rejected; the chance for economic growth which we are now creating will be lost. The country will be destined to another growth of unemployment and a further decline in the standard of living," states the Ministry.