photo: tanea.gr

At today's meeting , the Greek Securities Commission decided that the Athens Stock Exchange open its doors after a five-week hiatus following the imposition of capital controls in the country.

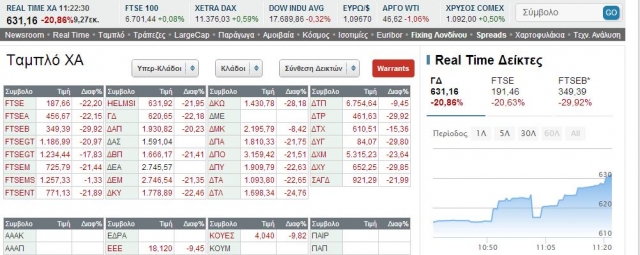

Immediately after the start of today's session, the banks' warrants slumped by 50%. The total collapse at the moment is about 22%.

20 minutes after the opening, the shares of the National Bank of Greece experienced a limit down (-30%) to a price of €0.840. The shares of the other three systemic banks are going through a similar ordeal. Piraeus' paper has gone down by 30% and now is worth €0.280, Eurobank's slumped by 29.86% to €0.101, while Alpha Bank has seen losses in the order of 29.81%, with a share price of €0.226.

At the same time, investor interest, especially of Greek investors, has been meagre. Hundreds of hedge funds are scraping to sell the Greek securities they hold, while Greek investors are in a stalemate. They cannot make deals unless they have cash reserves in stock-listed companies (it is believed that they amount to no more than €70 million in total) or unless they deposit cash into the 'new money' accounts, which were created in the banks.

Three hours after the start of today's session, losses on the main index of the Athens Stock Exchange fell to 18% and 655 points from the initial 22.8%. The volume of transactions is rather small and reaches only 25 million.

In a statement to Bloomberg, the CEO of the Athens Exchange, Sokratis Lazaridis, said: "Nobody expected that the current situation on the stock exchange would be good. It is difficult to say whether the rules are fair to Greek investors as a result of capital controls." He added that the accounts of Greek investors in the stock-listed companies hold roughly €165 million, and securities can be bought with this sum. Asked whether there is a risk of many companies delisting from the Athens Stock Exchange, Lazaridis said he was hopeful this wouldn't happen, and pointed out that the exchange's closure was a serious setback. His projection for the end of today's session was that hardly any class of shares would make a positive jump.

The last session of the Athens Stock Exchange on 26 June ended up at 798 points and an increase of 2% in anticipation of an agreement between Athens and the creditors on the same day. There were even expectations that a week of growth would follow, with the index rising to 900 points.

Following the Greek government's decision to leave the negotiating table, capital controls were imposed and banks were closed on June 29th. A day later, the exchange shut down because the stock market was rendered impossible.

Expect further details.