Photo: Ethnos

The general price index of the Athens Stock Exchange plunged to 589 points on Monday, scoring its lowest value in the last 20 years. Banks felt the strongest market pressures as their shares have been tumbling and only an hour after the opening of the stock market, their value dropped by 7%. "This is the result of the current political uncertainty and the constant statements from Europe that Greece may not remain within the euro," said for Naftemporiki Natasha Roumantzi, a financial analyst at Piraeus Securities.

Moody's credit ratings warned that after 6 May this year, it has become more probable for Greece to leave the euro area than ever before. The credit agency reports that if the country leaves the euro it will have dire consequences (negative credit) for Greek banks. The agency also notes that there has recently been an increased rhetoric by Greek politicians for possible revocation of the austerity measures. Meanwhile, European Union leaders have confirmed that they will not renegotiate the terms of the agreement for financial assistance. Greece will have to meet its commitments, implement the economic reforms in order to receive the tranches of the financial assistance of 130 billion euro.

Moody's credit ratings warned that after 6 May this year, it has become more probable for Greece to leave the euro area than ever before. The credit agency reports that if the country leaves the euro it will have dire consequences (negative credit) for Greek banks. The agency also notes that there has recently been an increased rhetoric by Greek politicians for possible revocation of the austerity measures. Meanwhile, European Union leaders have confirmed that they will not renegotiate the terms of the agreement for financial assistance. Greece will have to meet its commitments, implement the economic reforms in order to receive the tranches of the financial assistance of 130 billion euro.

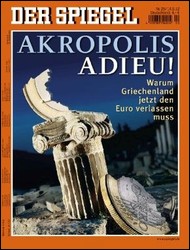

The German edition Der Spiegel, which had previously supported the view that Greece should remain a loyal member of the euro, this week, published an article entitled "Akropolis Adieu!" The edition traces the development of the Greek crisis and the conclusion of German analysts is that if Greek people (as according to results) do not want to comply with the conditions of the financial assistance, it is better to leave the euro. The majority of Greeks have decisively rejected the austerity measures imposed by the European Union and the situation seems hopeless, reads the publication. The website of the German edition quoted the Finance Ministry of Germany, "Greece will receive assistance even after leaving the euro." According to the information, in the event of a return to the drachma, the European Financial Stability Facility (EFSF) will cease to pay the funds agreed to finance the Greek budget (salaries, pensions, internal financing), but will pay the money to repay the external debt as agreed under the Memorandum of financial assistance. The main reason to continue to repay the debt is to not disturb the balance of the European Central Bank and the countries that have already lent to Greece.

The German edition Der Spiegel, which had previously supported the view that Greece should remain a loyal member of the euro, this week, published an article entitled "Akropolis Adieu!" The edition traces the development of the Greek crisis and the conclusion of German analysts is that if Greek people (as according to results) do not want to comply with the conditions of the financial assistance, it is better to leave the euro. The majority of Greeks have decisively rejected the austerity measures imposed by the European Union and the situation seems hopeless, reads the publication. The website of the German edition quoted the Finance Ministry of Germany, "Greece will receive assistance even after leaving the euro." According to the information, in the event of a return to the drachma, the European Financial Stability Facility (EFSF) will cease to pay the funds agreed to finance the Greek budget (salaries, pensions, internal financing), but will pay the money to repay the external debt as agreed under the Memorandum of financial assistance. The main reason to continue to repay the debt is to not disturb the balance of the European Central Bank and the countries that have already lent to Greece.

Former President of the European Commission and ex-Prime Minister of Italy Romano Prodi warned in turn that if Greece came out of the euro, other European Union countries would collapse like paper towers. "Greece represents only 2% of GDP in the euro area, with is certainly insignificant. If however it exits the common currency, speculation, which will sweep Athens, will continue to be hungry and affect Portugal, Spain, France and Italy," assessed Prodi.