Photo: To Vima

The Canadian investment fund Fairfax Financial Holdings has bought shares worth 1.3 billion euro in the process of Eurobank recapitalization, thus becoming its majority shareholder. The official announcements are about to be made in the coming hours, after the closing session on the Athens Stock Exchange. Pieces of information show that the stock price ranged between 0.30 euro and 0.35 euro.

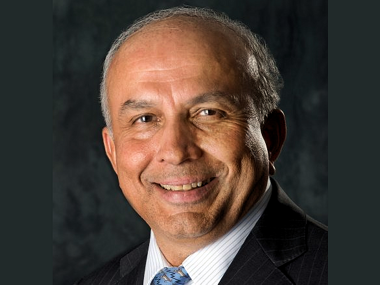

Fairfax Financial Holdings already holds 42% of Eurobank Properties as well as of the companies Mitilineos and Praktiker Hellas. "We continue to believe in the recovery of the Greek economy under the leadership of Prime Minister Antonis Samaras," chief executive Prem Watsa, who has headed the Canadian company since 1985, said last week. Because of his investment acumen, Watsa is often called Canada's Warren Buffett.

Fairfax Financial Holdings already holds 42% of Eurobank Properties as well as of the companies Mitilineos and Praktiker Hellas. "We continue to believe in the recovery of the Greek economy under the leadership of Prime Minister Antonis Samaras," chief executive Prem Watsa, who has headed the Canadian company since 1985, said last week. Because of his investment acumen, Watsa is often called Canada's Warren Buffett.

At present Greece’s Financial Stability Fund holds 95% of the shares of Eurobank that is trying to increase its capitalization and raise 2.89 billion euro from the markets. In addition to Fairfax Financial Holdings, the auction involves the major Fidelity, Wilbur Ross and Mackenzie investment funds.

To be continued.