Photo: Vima

Greece will receive 18 billion euro next week to recapitalize the banking sector. The funds will feed the Hellenic Financial Stability Fund, which was established in late April this year. It will provide the banks with the resources they need to fill the hole in their budgets, opened after the reduction of the nominal value of Greek government bonds held by private creditors. The funding comes in the form of bonds of the European Financial Stability Facility, rated AAA - the highest rating in the scale of credit rating agencies. "Procedures to allocate the funds should be concluded by next week," the head of the Hellenic Financial Stability Fund, Panagiotis Thomopoulos, told Reuters. "The money is here but there are procedures involving many stakeholders - the EU/IMF/ECB troika, the Bank of Greece, the EFSF - that must be completed and this takes time. All sides have to be on board," he said.

Meanwhile, political developments in Greece have intensified the rhetoric inside and outside Greece for a possible return of the drachma. The head of the Institute of International Finance Charles Dallara forecasted a crisis greater than that caused by the collapse of Lehman Brothers if Greece came out of the eurozone. According to the Financial Times, 1.3 billion in deposits have been withdrawn from the banks since the beginning of the week and the trend is getting worse with the deepening of uncertainty in Greece. The outflow of funds will stop when things stabilize and when it is guaranteed that Greece will remain in the eurozone, said Dallara. He believes that stability will come "once you get a new government in place, if that government reaffirms its intention to remain in the eurozone." The damage to the rest of Europe if Greece were to leave the euro would be "somewhere between catastrophic and armageddon", said Dallara as quoted by The Guardian.

The same edition states that a possible uncontrolled bankruptcy of Greece could cost eurozone countries up to one trillion dollars. Doug McWilliams of the Centre for Economic and Business Research estimated that the controlled bankruptcy of Greece will cost about 2% of eurozone GDP or 300 billion dollars and the uncontrolled bankruptcy would result in an overnight 5% drop in the total GDP of the 16 states of the Union. In conclusion, he said, "The end of the euro in its current form is a certainty. A currency with the name euro may survive but even if it does it will be radically transformed."

German Foreign Minister Guido Westerwelle said that Greece is now invited to vote not only for a government but also "for" or "against" remaining in the euro area. He stressed that Europe will be next to the Greek people, but economic growth can be achieved only through reforms - a task that depends entirely on the Greeks themselves.

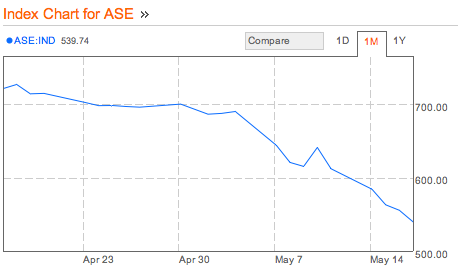

Despite the positive signals sent from central Europe, the situation in Greece is getting worse each day. The representative of the International Monetary Fund David Holley announced at a press conference that the institution is technically ready to face even the most negative scenario for Greece and the supervisory Troika will not return to Greece until a permanent government is elected. Athens Stock Exchange continues to collapse and the main index (ASE) reached a record low of 536.49 basis points at the end of the day. The loss was 3.41% and the turnover did not exceed 47.7 million euro. Imerisia commented on the new record low as a return to 1980.

Source: bloomberg.com