Anastasia Balezdrova

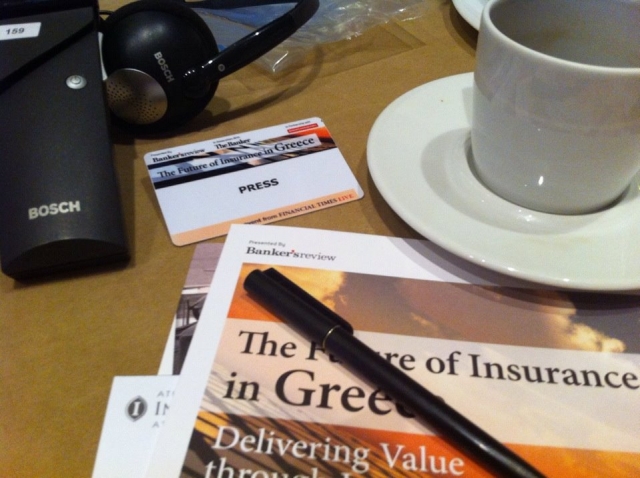

"20 years ago, the share of the insurance market in Greece’s GDP was 2% whereas the European average was 5.7%. Today it is only 2.4% in Greece and its European level has reached 7%," said Alexandros Sarrigeorgiou, head of the Association of Insurance Companies and CEO of Eurolife ERB, during a forum on "The Future of Insurance in Greece".

In his words, the turnover of the Greek insurance companies in 2007 was 5.5 billion euro whereas the calculations for 2013 show that its amount is 4 billion euro. At the same time, in recent years, the insurers have reported losses of about 2.1 billion euro as a result of the public debt haircut.

"The market is not growing and the Greeks remain uninsured. In the years before the crisis, public insurance was mostly stimulated but the system has failed and it is unable to meet the demands of citizens at present. We are presented with a significant opportunity but our success depends on our credibility," said Sarrigeorgiou. He informed his colleagues on the European Solvency II Directive, which aims to change almost the entire philosophy of the insurance supervision. Sarrigeorgiou noted that the specific directive and other EU regulations are indispensable to the Greek insurers who will be able to correct some bad practices and to create a properly functioning system.

"The market is not growing and the Greeks remain uninsured. In the years before the crisis, public insurance was mostly stimulated but the system has failed and it is unable to meet the demands of citizens at present. We are presented with a significant opportunity but our success depends on our credibility," said Sarrigeorgiou. He informed his colleagues on the European Solvency II Directive, which aims to change almost the entire philosophy of the insurance supervision. Sarrigeorgiou noted that the specific directive and other EU regulations are indispensable to the Greek insurers who will be able to correct some bad practices and to create a properly functioning system.

The head of the Association said that the Greek insurers have already begun discussions with the authorities on cooperation in the field of insurance. "There are many examples of successful cooperation around the world. The decisions must be taken quickly because their application requires time that we do not have," he said in conclusion.

The insurance market is actually stagnant but the trends are positive as stated by Michalis Masourakis, chief economist at Alpha Bank. He said that the Greek economy is in a phase of slow recession and that it is expected to improve in 2014. According to his estimates, it will report 1.1% growth at the beginning of 2014 which will reach 1.5% in the autumn of the same year.

"The loss of jobs is about to end. Nevertheless, economic recovery will be gradual and slow, and it will have nothing to do with the economy that we remember from the time before the crisis. Now jobs will be the result of competitive production." He added that this would depend on the continuation and acceleration of structural reforms by the government.

"The loss of jobs is about to end. Nevertheless, economic recovery will be gradual and slow, and it will have nothing to do with the economy that we remember from the time before the crisis. Now jobs will be the result of competitive production." He added that this would depend on the continuation and acceleration of structural reforms by the government.

According to Masourakis, the economic indicators show improvement in all industries, and it is expected that this process will intensify in the coming months. "This year for the first time we will achieve a primary budget surplus which will stabilize. This will be the result of the changes in the structure of the macroeconomic indicators."

Michalis Masourakis pointed out that the increase in the rate of unemployment is already slowing down and that improvement in recruitment has been reported. Regarding the status of Greek banks, he said that capital to the amount of 90 billion euro had been exported. "After the debt haircut, 15 billion euro were returned to the banks, 4 billion euro of which came from foreign banks. This process has been interrupted and is now slower following the cuts in the deposits of citizens in the Cypriot banks in March this year."

With regard to the insurance market, in his opinion, its environment will improve in the coming years. As for the expectations of insurers that they will take over part of the pension insurance, the economist said, "The Greek pension system has not been destroyed, we have been able to save it and, from this point onwards, it will be sustainable. So my advice is to ask for adjusting the conditions for competition to those that apply to other organizations that provide the same services," said Masourakis, referring to the public pension funds.

"The main reasons for the shrinking insurance market are the recession that has reached 25%, unemployment (25%) and the reduction in income by about 41 billion euro if the data we have obtained from the institute to the union of private sector employees GSEE are accurate," Margarita Andonaki, Executive Director of the Association of Greek Insurance Companies, said in her presentation. This has led to a decrease in the purchasing power of the Greeks by 22% and to the shrinking of the middle class that has traditionally been the most stable client of insurers.

"The main reasons for the shrinking insurance market are the recession that has reached 25%, unemployment (25%) and the reduction in income by about 41 billion euro if the data we have obtained from the institute to the union of private sector employees GSEE are accurate," Margarita Andonaki, Executive Director of the Association of Greek Insurance Companies, said in her presentation. This has led to a decrease in the purchasing power of the Greeks by 22% and to the shrinking of the middle class that has traditionally been the most stable client of insurers.

According to her, Greek society lacks the awareness of the need for insurance. "We are only 23rd in Europe with regard to this indicator. However, the crisis cannot be an excuse since in Portugal, where there is a crisis too, the insurance activity has increased threefold."

"Until very recently, the rate of the additional state funding to the social security funds reached 95%. This fact had a negative effect on the probability of taking measures for additional insurance. Only 15% to 20% of Greeks have preferred private insurance until recently. I think the idea itself is not sufficiently widespread. Furthermore, the need for insurance is not present in the educational process and such awareness cannot be created."