Photo: naftemporiki.gr

Greece is becoming the centre of foreign investments and foreign funds are seeking investment opportunities in Greek bonds as shown by the movement of bonds and shares. The bonds that are drawing attention are the warrants that are directly related to the development of the Greek economy. An article in yesterday's edition of the "Wall Street Journal" suggests that investments in warrants should be made as they are defined as specific securities with immediate return if the economy recovers.

Private sector involvement

The analysis points out that during the major debt restructuring implemented by Greece last year, the holders of the old bonds involved in the SWAP exchange of Greek bonds held by private lenders, known as PSI, obtained warrants with return on investment if the country failed to achieve the objectives of the Gross Domestic Product (GDP). The bonds with a GDP clause are traded on the secondary markets, but the volume of transactions is small. However, there have been some recent developments. In particular, the warrants moved around 1.19 euro on Wednesday according to Reuters whereas they cost less than 0.5 euro in the summer of last year.

The movement of bonds is a positive sign as noted by Yiannos Kondopoulos, group chief investment officer of Eurobank, Athens. The warrants are the most direct way for securing a place in the future development of Greece and the movement of prices shows that the markets are beginning to reassess the Greek economy before the financiers.

The fact is that financiers are disappointed because the Greek GDP plunged by 5.3% in the first quarter and the country's problems are still serious. At some point, however, things will change according to the analysis in the "Wall Street Journal". The question is when this will happen and how fast, and it seems that the market of warrants provides optimistic answers. As for "why," the structure of these products needs to be considered.

Following the history of Greek warrants, the article in the "Wall Street Journal" notes that Greece introduced warrants of nominal value of 62.4 billion euro and that the investors obtained one warrant for each euro of the new government bonds they received during the restructuring. The value of the warrants has never reached 62.4 billion euro. Instead, almost 1% of the nominal value will be paid each year from 2015 to 2042, although the Greek GDP had achieved the objectives set in the previous year.

Starting from 2023, the nominal value of the warrants will decrease. In the best case scenario, the holder of warrants will receive in the end 18.6% of the initial nominal amount paid in instalments within 28 years. Last year, after the Greek economy defaulted, the investors did not believe that the warrants would be valuable; today, however, they believe so. Nevertheless they are not so valuable, as at the price of 1 euro, the total value of the warrants is calculated at 624 million dollars, the Greek public debt is more than 300 billion dollars and the larger part of it belongs to the European lenders. The value of the warrants largely depends on how quickly the Greek GDP will recover.

Stake on GDP and earn

The method of determining the return on the warrants is complex, but the point is that Greece needs to reach a specific target for the GDP so as to pay the securities. The target will increase each year until 2020, after which it will remain constant. If Greece does not achieve the goal, there will be no payment for that year. Theoretically, the payments on the warrants may begin in 2015 if the nominal GDP of Greece surpasses 210.1 billion euro, which is the amount set for 2014. However, this is unachievable. The estimates of the commission are for 183.5 billion euro in GDP this year. Analysts acknowledge that, most probably the payments will begin in 2023. When the price of warrants is increasing on the market, it is a good indication that investors believe that Greece will develop faster than expected.

Stocks and bonds are demanded

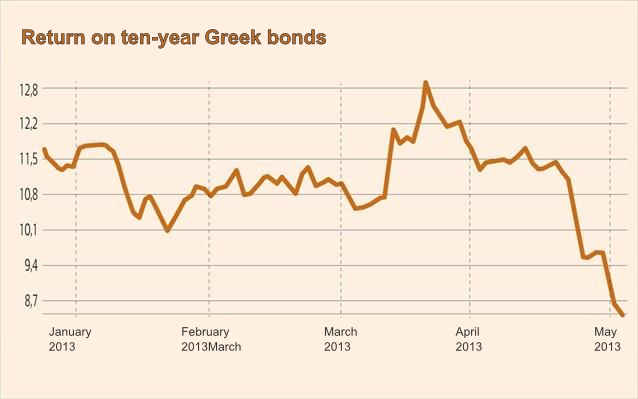

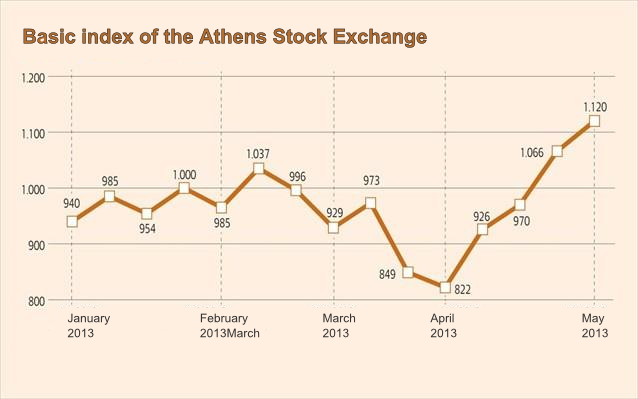

Despite the investments in warrants, the markets of stocks and bonds indicate a change in investors’ attitude towards the country. Indicative of this is the "convenience" with which the Athens Stock Exchange reached 1.100, realizing increased endorsement of banks.

Stock exchange sources are optimistic that the Athens Stock Exchange has the power to grow even further if the international markets remain at historically high levels. The good course of the markets has created significant liquidity, which has made hedge funds seek risky return staking on stocks and bonds with higher returns.

China and investors stake on Greece

Greek Prime Minister Anonis Samaras was on a five-day visit to the second largest economic power in the world in order to attract Chinese companies in the Greek privatization programme. In parallel, Greece is at the epicentre of foreign investments. In addition to large international funds, small aggressive hedge funds are operating in the market, mainly in the market of bank shares.

In 2013, bonds that raised 2 billion euro were issued. The funds York Capital Management, Dromeus Capital, LNG Capital and CQS LLP are some of the buyers. It is noted that Daniel Loeb’s Third Point LLC has launched a hedge fund dedicated to the purchase of Greek assets. The foreign press is regularly writing about the bonds of the telecommunications company OTE and of the Greek petrol company as well as about Frigoglass’ bond loan.