Picture and graphics: www.naftemporiki.gr

Piraeus Bank is foreseeing major business deals by the summer via mergers, which are being dictated by the market itself.

Operational costs need to be reduced and bank financing has to be facilitated and this will result in mergers and the creation stronger formations, Deputy Executive Director of Piraeus Bank Christodoulos Antoniadis explained.

The market is expecting the creation of new formations after the joining of forces, the arrival of new investors and capital recovery via lending. The intervention of banking groups will be more active in the next period within a more dynamic portfolio management. Proposals of the Bank of Greece and the necessity for the banking system to focus on the financing of the competitive part of the economy are showing the way. Significantly, Governor of the Bank of Greece George Provopoulos has repeatedly spoken of stronger and larger formations.

At the Thessaloniki press conference, Antoniades was asked about the reduced levels of liquidity in the real economy. He emphasized that banks have never refused funding to viable companies with real survival prospects.

"We have never refused money to exporters and innovative enterprises, even in the most difficult times," he said, adding "Banks manage deposits and not personal wealth. In many cases, restructuring of loans is inevitable, but we must check whether entrepreneurs who have submitted such requests have restructured their companies and even their way of life."

Participation of entrepreneurs in corporate restructuring has emerged as an important part of the process, the bank manager noted, and this largely determines the attitude of banks, too. Recent contacts with companies from certain sectors have shown that unlike the recent past, inaction and tactics of delaying or refusing to participate with the same tools have resulted in a more severe attitude of lending banks.

When asked about the possibility of a further reduction in lending rates, Mr. Antoniades said that it depended on the size of deposits and the stable economic climate. According to him, "The Greek economy has been restored and we must not try to get back to what we have left behind - illusions of unrealistic wealth."

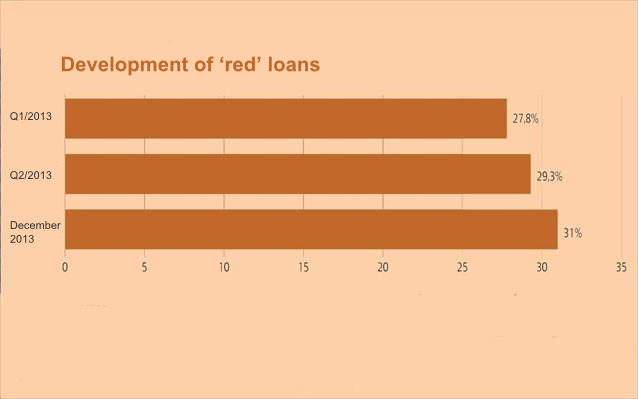

The Deputy Executive Director of Piraeus Bank pointed out that since the spring of 2013, the dynamics of red loans has been limited and added that this trend will continue in 2014.

The more vigorous management of delayed loans is the main activity of banking groups and the operation of special departments dealing generally with detection, management and debt restructuring has already begun.

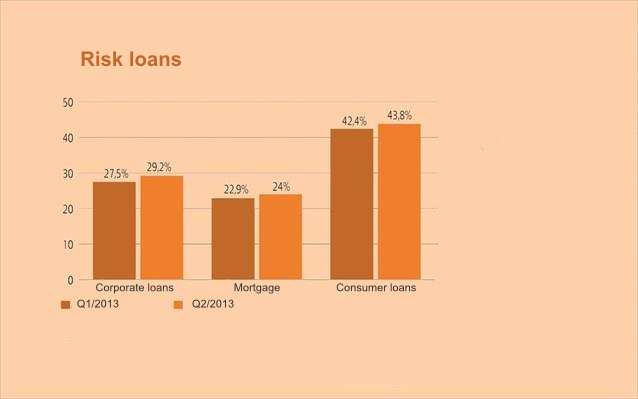

The banking system was loaded with about 12 billion euro of new "red" loans in 2013, in this way increasing the volume of risk loans to at least 67 billion euro. The Bank estimates that the indicator of delays was 31% in December, compared to 29.3% according to the latest official data for the second quarter.

Banks are trying to systematically deal with the problem, despite assurances that the number of new risk loans was smaller in the last two quarters. The volume of "red" loans is significant and the payment of about 35 billion euro has already been delayed with two months.

A special department in each bank will undertake the management, validation of delays and loans restructuring where necessary, via international practices which have not been applies by Greek banks so far.

Tourism

According to Christodoulos Antoniadis, tourism is a sector attracting foreign investment capital and Greek banks and various funds are discussing the funding of tourism synergies and investments.

The National Bank of Greece is proceeding to the creation of a bad bank

www.imerisia.gr

Yesterday, the National Bank of Greece announced the creation of a new department for corporate lending with a special management, which will be headed by Director General Petros Fourtounis. The goal is the better credit management.

The new unit will aim at the effective implementation of restructuring programmes, which will contribute to the viability of companies. According to the bank, the success will result in profits for the bank, thanks to the effective dealing with subprime loans.

In parallel, healing and support of sectors of the Greek economy and Greek companies in the critical phase of their recovery will be accelerated.

Initially, the sector will focus on medium-sized and small companies, as well as on certain portfolios of large companies.