Photos: Ethnos, Imerisia; Chart: GRReporter

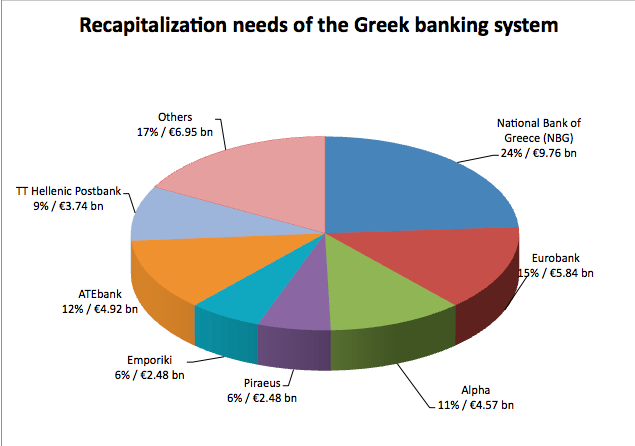

Greek banks need a total of 40.7 billion euro in financial aid to keep the local financial system alive. The four major Greek banks - National Bank of Greece (NBG), Eurobank, Alpha Bank and Piraeus need a total of 27.5 billion euro to turn the corner of the crisis and continue to operate. The data presented by the Bank of Greece in the public domain are based on the conclusions of the study of the financial system in the country carried out by BlackRock. The analysis shows that the total credit risk in the country is worth 46.8 billion euro. It includes 36.8 billion euro in recapitalization needs, 8.2 billion euro to cover external loans and 1.8 billion euro in loans to the public sector.

The capital needs of the National Bank of Greece (NBG) are set at 9.76 billion euro, those of Eurobank are 5.84 billion euro, Alpha Bank needs 4.57 billion euro and Piraeus Bank – 2.48 billion euro. The BlackRock's report states that Post Bank (TT), which is still state-owned but is to be privatised, will need 3.74 billion euro for recapitalization. The Agricultural Bank or ATEbank, which was acquired by Alpha Bank, needs 2.47 billion euro. Its previous owner Credit Agricole covered this amount as it had covered its recapitalization needs before selling it.

The Bank of Greece insists that the recapitalization of the financial system in conjunction with its consolidation will help restore the confidence of markets in the Greek economy. Government officials say that the pouring of support capital into local banks will have a positive effect on the real economy of the country as well but financial experts disagree with this assessment. Representatives of banking circles do not hide the fact that the funds of the Financial Stability Fund will stabilize the institutions, but they will not provide free resources for lending to the businesses in the country.

Representatives of banking circles do not hide the fact that the funds of the Financial Stability Fund will stabilize the institutions, but they will not provide free resources for lending to the businesses in the country.

The money that banks receive in stages with the aid tranches to the country is aimed at meeting the capital adequacy requirements of the Bank of Greece. BlackRock assumes that the capital adequacy ratio of banks (Core Tier 1 ratio) in 2012 is 9% and 10% for 2013. The damage to bank balance sheets caused by the private sector involvement in the restructuring of the external debt (PSI) and the buyback of bonds held at the end of this year is taken into account in calculating the capital requirements.

Naftemporiki reports that the bank losses from the haircut of the face value of Greek bonds reaches 37.7 billion euro. Imerisia confirms this information and adds that the total loss to the banking system due to the PSI and the growing number of bad loans reaches 84.5 billion euro.

Banks must carry out the bridge recapitalization from the Greek Financial Stability Fund, which is in the  form of an advance against future capital increases planned for implementation by the end of April 2013. Meanwhile, by the end of January, the Fund will issue contingent convertible bonds (Cocos), which will be distributed in compliance with the recapitalization needs of the four major financial institutions. The increase in share capital will be completed by the end of April 2013 and the Financial Stability Fund would act as a warrantor. Private shareholders will retain the shares in their banks if they deposit at least 10% of the value of the new ordinary shares issued. The fate of the smaller banks will be decided once it becomes clear what will happen with the big banks. They are also expected to resort to mergers, acquisitions and possible state aid until June 2013 in order to ensure financial stability and the interests of depositors.

form of an advance against future capital increases planned for implementation by the end of April 2013. Meanwhile, by the end of January, the Fund will issue contingent convertible bonds (Cocos), which will be distributed in compliance with the recapitalization needs of the four major financial institutions. The increase in share capital will be completed by the end of April 2013 and the Financial Stability Fund would act as a warrantor. Private shareholders will retain the shares in their banks if they deposit at least 10% of the value of the new ordinary shares issued. The fate of the smaller banks will be decided once it becomes clear what will happen with the big banks. They are also expected to resort to mergers, acquisitions and possible state aid until June 2013 in order to ensure financial stability and the interests of depositors.

"The Greek banking sector was severely hit over the past few years by the combined effects of the restructuring of Greek sovereign debt and adverse economic conditions, both of which affected the banking assets and deposits. The report published today results from the requirements set in the Memorandum of Understating. In this report, the European Commission, the European Central Bank and the International Monetary Fund provided guidance and ensured the consistency with the programme’s objectives," states the Bank of Greece.