Photo: GRReporter

Victoria Mindova

In recent years, Greece and many other countries of the European periphery have entered a new phase of their existence, for which the ordinary citizens have not been prepared. Greece has lost a quarter of its national production, the standard of living of Greek people has fallen by 30% and the prospects for recovery appear to be out of reach, just like the horizon - the more you move forward, the more it moves away.

In Cyprus, the banking crisis has also changed the situation. The series of reports, interviews and analysis broadcast for days were focusing on the state of the Cypriot banks, public sentiment and the possible scenarios for the development of the new crisis in the euro zone. After a 12-day freeze on activity, banks have reopened to the public.

Dozens of TV crews from all over the world flocked to Nicosia to cover the anger, resentment and extreme acts they had expected to explode after the recovery of the bank services. Greek, Spanish and Portuguese protests no longer seriously affect the international community, but Cypriots would have given a new twist to the turmoil in south Europe. It was expected that people might leave the bank branches with bags of money, ready to put it under the mattress to save it. It was expected that there might be fighting and wrangling in the queues at the banks, robberies in the streets, riots and protests against the central government.

None of this happened.

BBC’s leading news on Thursday, 28 March, was Cyprus, but not as the island of despair and unrest, as expected. A Cypriot citizen had drawn the attention as he had been lining up to deposit money to cover current liabilities instead of withdrawing it. So, the new crisis in the euro zone that has erupted in Cyprus has not performed the expected and even desired show before the world media.

However, the problems that have emerged in south Europe due to the financial crisis that lasted much too long will have a lasting impact on people. Greece’s debt restructuring, for example, has reduced the burden of obligations to private investors by 100 billion euro but it has also swept away the lifetime savings of 15,000 Greeks and it continues to drain the current income of 11 million citizens.

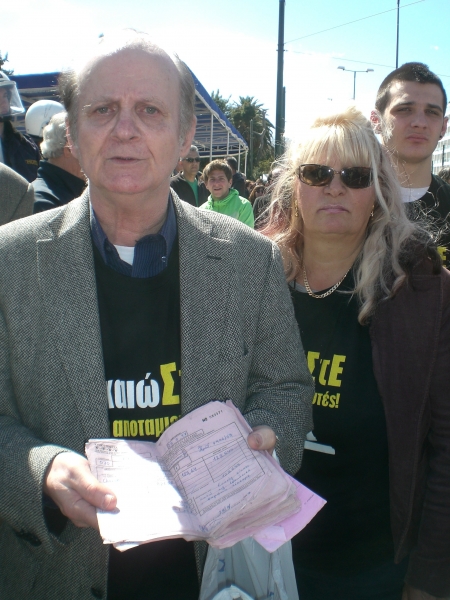

Individual persons, who before the collapse of Lehman Brothers had been tricked into putting their  savings into government bonds because they were safer than bank deposits, irretrievably lost their life savings. During one of the numerous protests, GRReporter met an elderly man who has become one of the thousands of victims of the state propaganda. "I worked in Germany for more than 20 years, mainly in restaurants. Once life became easier, I decided to return to Greece. They were begging me to transfer my savings from the German to the Greek banks," he said, showing me the documents of the deposits.

savings into government bonds because they were safer than bank deposits, irretrievably lost their life savings. During one of the numerous protests, GRReporter met an elderly man who has become one of the thousands of victims of the state propaganda. "I worked in Germany for more than 20 years, mainly in restaurants. Once life became easier, I decided to return to Greece. They were begging me to transfer my savings from the German to the Greek banks," he said, showing me the documents of the deposits.

"I am now 72 years old. When the maturity for the payment of the money on the new bonds, the value of which is 60% lower than what I have deposited comes, I will have died five times," the elderly man said with irony. In addition, he noted that if the same law were in force, his heirs, who would most probably be his grandchildren, would be subject to a 35% inheritance tax. "They mocked us, used us and now we are at an impasse," he said angrily.

The people are seriously frustrated by the fact that the government and the bank employees were assuring them in 2008 that the investment in government bonds was the safest way not to lose their money. They were persuading them to withdraw their money from bank deposits and buy bonds at a time when the financial circles already knew that Greece had a serious problem. Currently, the elderly man is experiencing difficulties in buying the medicines prescribed to him - his pension has been reduced, social benefits and health care costs have been cut. "If our savings, which we were amassing in our lifetime, would have saved the state, we would have given them, we are ready to give our clothes if we must! But they neither put the country in order, nor did anyone come to explain why they lied to us."

Individual persons who have invested in Greek government bonds are a representative sample of the financial genocide the rulers of the country and Europe have imposed to correct the mistakes of the past. The most vocal opponents of the bailout to Greece claim that after the Greeks have been relying on European Union money for so many years, now is the time for them to take care of themselves alone. Some go even further and frankly say, "It serves them right". However, all of them forget something very simple that my father repeats from time to time - the fool asks much, but he is more of a fool he who grants it.