Victoria Mindova

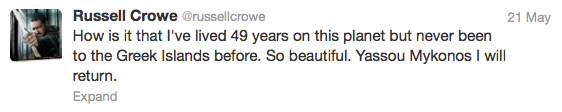

"How is it that I’ve lived 49 years on this planet but never been to the Greek islands before. So beautiful. Yassou Mykonos I will return." This is Russell Crowe’s twit that melted the hearts of Greeks this week. The hospitality and the natural beauty of the island of winds delighted the Hollywood star and he has reminded the world that Greece is not only the country of unrest and crisis.

Owning a piece of paradise on earth is not only a privilege of Madonna, Tom Hanks or Angelina Jolie, especially after the decline in real estate prices. GRReporter has sought the expert opinion of the chairman of the body of sworn-in property valuers Babis Haralabopoulos to tell us whether the time has come for us to look for property in Greece.

Real estate prices have significantly dropped after the long recession. Do you think that there are already good opportunities for investing in real estate in Greece?

Prices have actually dropped and there are very good offers for the purchase of real estate in Greece. However, market research and good negotiations are required. At present it is the buyers rather than the sellers in the market who have the strong hand. The number of those who want to sell is large but few are ready to buy.

There is something specific here. In Greece, there are two types of sellers at present. The first type involves those who want to sell their property but who are not pressed by the necessity of paying specific obligations (payments to banks, taxes and other costs). They would offer a smaller discount compared to the period before the economic collapse (15% -20%).

There is something specific here. In Greece, there are two types of sellers at present. The first type involves those who want to sell their property but who are not pressed by the necessity of paying specific obligations (payments to banks, taxes and other costs). They would offer a smaller discount compared to the period before the economic collapse (15% -20%).

The second type includes those sellers who owe large amounts to the tax authorities or financial institutions and who are willing to undercut the price just to be able to obtain free resources. In these cases, you can find very good prices, which are 60% to 70% lower compared to the prices before the crisis.

The two conditions you have to remember in order to make a successful investment in property in Greece are to better explore the potential of the market and to be ready for serious negotiations in order to buy at the best possible price. The real estate market really offers good opportunities for successful investments, mainly for people with available funds.

How has the real estate market changed during the crisis?

The average decline in the market price of houses is 30%. The demand for small flats has remained high and the price reduction as a result of the crisis is at its lowest in this market segment. As for luxury flats with a large area, the price has decreased by even more than 50% compared to the period before the economic crisis.

The rent of premises for commercial activity has also declined. There is a serious devaluation in this type of real estate. The reduction there reaches 60%, sometimes even 70%. Look at the situation in one of the most central streets of Athens, namely Stadiou Street. Almost half of the premises there are empty today. When they must be closed during four out of six days because there are protests, strikes or vandalism sometimes, the retailers cannot survive. This explains the decline in their market value.

When the economy is in recession, businesses and enterprises close every day. There are thousands of square metres that remain empty and without users. This has also saturated the market with office space offered at much lower prices. The decline in them varies between 30% - 40% and so far, there has been no demand in order for them to be filled. When the official unemployment rate is nearly 30%, you know, there are no companies to operate.

The new property tax, which came into force two years ago, is also exerting pressure on prices. It is more costly to own a large property in Greece now than several years ago. There are many properties for sale but very few buyers. I think that prices will continue to fall for at least another year.

Several years ago, the tax assessments were significantly lower than the market value of the property. What is the situation at present?

Currently, it is the opposite. For the most part, the tax assessments, which have not changed since 2007, are higher than the actual price of the properties. Their value is important because it will determine the tax that you will pay on the property. A special commission has been formed to determine new tax assessments that meet reality. This means that we could expect a reduction.

However, if the government insists on collecting three billion euro from property taxation, then I do not think that there will be a significant change in the tax assessments. What we could expect is that the tax assessments of the houses in poorer neighbourhoods would increase. For many years, the tax assessments there have been artificially low following a political decision. It was part of the social policy, which applied to poorer neighbourhoods, rural or remote regions. Under it, tax concessions were made to the people in order for them to remain in the areas.

I think the government could have used a different strategy to support the economically undeveloped areas. It could have left the tax assessments at their actual levels and reduced the tax rates.

For the first time in many years, international analysts have begun to positively comment on the economic situation of Greece. How will this affect the market in your opinion?