Pictures: www.imerisia.gr

Higher and extra taxes, especially over-taxation of rental income, are seriously affecting the real estate market. A typical example shows that an apartment owner in Greece, whether he or she lives there or rents the place, will pay taxes amounting to between 2 and 6 rents out of a total of 12 that he or she would otherwise get from the apartment. As a result, home ownership is becoming unprofitable and an increasing number of homes are going on the market for sale. About 200,000 - 270,000 vacant homes, zero demand and demographic problems show that it would take more than 8 years for the market to return to its 2005 levels. These are the main conclusions of a study about the shocking and dramatic situation of the real estate market, which was once the "locomotive" of the economy. The study was carried out by scientists from the University of Economics in Athens, led by professor of statistics Epaminondas Panas. The study describes specialists’ expectations about the market in the second half of 2013.

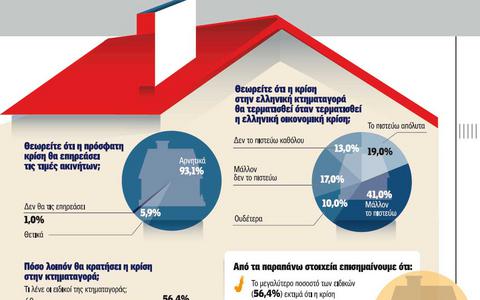

9 out of 10 professionals from the sector (89.1%) believe that the crisis will last from 1 to 3 years. Furthermore, 93.1% of them admit that the crisis will affect real estate prices, and 79.9% expect a great retreat in the next 6 months.

The great absurd

The most striking information is related to absurdities in taxation of real estate with yet another general tax, which will come into force as of 2014. According to the study, and provided that the property tax rate will have 33 coefficients and move in the range of between 2 and 23 euro per square metre for an apartment of 75 square metres with a monthly rent of 5 euro per square metre, the owner will receive 375 euro per month or 4,500 euro per year. Assuming that the total tax rate is 10 euro per square metre, if someone owns a home and lives in it, they will have to pay the state 10 euro per square metre, i.e. 750 euro. Thus, they will pay tribute to the state for two months.

If the owner rents out the house, this income is taxed by a factor of 10% (for rents of up to 12,000 euro, and 11% as of next year). I.e., owners renting out an apartment will pay an additional 350 euro, which, together with a total of 750 euro tax, will amount to a total 1,200, euro, or 3.2 rents out of 12 rents will be paid to the state. It should be noted that if rents amount to more than 12,000 euro per year, they will be taxed by 33% for the excess amount. According to the University of Economics, confiscation of property is also possible, because of the application of coefficients of the new property tax, combined with the total tax for the taxation of rents. Owners who rent out apartments will provide up to 3 rents to the state, especially because of the dramatic decline in rents, even in expensive areas, provided that there are no respective reductions in taxes. For example, a tax amounting to 2,112 euro will be paid for an apartment of 100 square metres with an annual rent of 14,400 euro. If it is located in an expensive area with high tax assessment, the owner will have to pay 13 euro per square metre (i.e. 1,300 euro) and total taxes in 2014 will amount to 3,412 euro or 2.8 rents.

According to this logic, foreigners will not come and buy a holiday home because they will have to pay at least 2-3 rents per year. The study identifies the main reasons for the collapse of the real estate market as well as the main reasons which prevent its recovery. According to Pinas, it is not easy for someone to expect that the climate will change, bearing in mind that taxes are being constantly imposed, banks do not lend, and there is oversupply of real estate and no liquidity. The crisis of the Greek property market is deepening both because of the euphoria in 2004-2005 and the fact that the demographic problem, which is important for the market, is being neglected. Thus, the problem of the Greek market currently includes approximately 200,000 to 270,000 unsold homes that are contributing crucially to the crisis and preventing Greece's exit, despite the fact that construction activity has already decreased. Furthermore, homebuilders have not complied with the new conditions, nor have they reduced prices.

The main points of the study are the following:

- Dwellings are overvalued by 10-30%;

- The number of unsold houses amounts to at least 200,000;

- 56.4% of market specialists admit that the crisis will last 2-3 years, while others believe that it will end in two years. That is, 89.1% see no exit from the crisis in the next 3 years;

- 99% of experts believe that there is oversupply. 80% believe that there is a decline in sales today, compared to 6 months ago. 92.2% believe that sales prices have decreased compared to 6 months ago;

- 79.9% believe that prices will fall over the next 6 months. 50.9% expect a decline in housing demand in the next six months;

- 24% admit that the number of seizures of homes is greater compared to 6 months ago;

- 41.2% think that no price increases are expected. 24.5% believe that a price bubble is likely to be created;

- As far as commercial real estate is concerned, 96.9% believe that there is oversupply, 72.2% believe that there is a relative price decrease compared to 6 months ago; according to 67.7%, there will be an additional reduction and 57.2% believe that demand will be lower.

Unemployment and the demographic collapse are destroying the property market