Picture: www.star.gr

Employees and retirees will receive a lower net income as of the beginning of 2013 due to the new scale of taxation, which has already been implemented. In general, taxpayers with incomes above 20,000 euro will pay a higher level of tax this year, which can be reduced according to the number of children.

The new scale

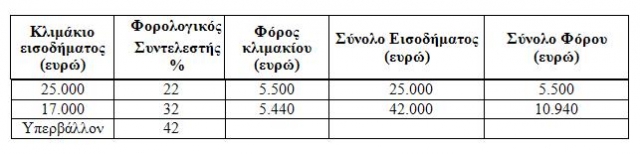

According to the tax law voted by Parliament, taxation rates for incomes of workers and pensioners will be changed as follows:

- for incomes of up to 25,000 euro, the tax rate is 22% and the maximum annual tax is 5,500 euro;

- for incomes from 25,001 euro to 42,000 euro, the rate of taxation is 22% for amounts of up to 25,000 euro and 32% for incomes above that amount, and the maximum annual tax is 10,940 euro;

- for incomes of over 42,000 euro, the tax rate is 42%.

The tax may be reduced upon presentation of receipts for expenses amounting to 25% of the annual income. A solid tax cut amounting to 2,100 euro will be implemented for incomes of up to 21,000 euro. For incomes higher than that amount, the tax will be reduced by 100 euro per 1,000 euro, until it reaches zero for incomes above 42,000 euro. Thus, if the annual income amounts to 5,000 euro, the tax due under the tax scale is 1,100 euro. In this case, the reduction because of receipts collected fully covers the annual tax and taxpayers will not pay anything. In the case of an annual income of 18,000 euro, the payable tax is 22% - i.e. 3,960 euro and a 2,100 euro tax reduction - the amount due is 1,860 euro. If the annual income is 22,000 euro, the tax due is 4,840 euro and a 2,000 euro tax cut - the amount payable is 2,840 euro. With an annual income of 26,000 euro, the tax due amounts to 5,820 euro while tax reductions reach 1,600 euro - the amount due is 4,220 euro. With an annual income of 31,000 euro, the payable tax is 7,420 euro and a 1,100 tax cut - the amount payable is 6,320 euro. At an annual income of 35,000 euro, the payable tax is 8,700 euro and a 700 euro tax reduction - the amount payable is 800 euro. If the annual income is 43,000 euro, the tax due amounts to 11,360 euro and tax deductions for receipts collected are not applied in this case.

The trick of tax reduction

There is a trick in this system which allows for the taxpayer to be burdened with 100 euro in the case of incomes that are a few euros above the threshold. This happens by virtue of the scale for reductions because of receipts, which decreases in parallel with the increase in income. The Ministry of Finance explained that for incomes exceeding 21,000 euro, 22,000 euro, 23,000 euro, 24,000 euro and up to 41,000 euro, respectively, when the difference between the income and the whole previous amount in thousands of euros (21,000 euro, 22,000 euro, 23,000 euro, 24,000 … 41,000 euro) is over 500 euro, then the reduction includes those 100 euro over the next amount in thousands, and if the difference is less than 5,000 euro, then the reduction also covers those 100 euro of the smaller amount. For example, if the income amounts to 29,499 euro, the taxpayer has the right to receive a tax reduction of 1,300 euro, and if the income is only 1 euro higher, or 29,500 euro, then the tax discount for receipts collected will be 1,200 euro. That is, for a difference of one euro, the tax is 100 euro higher.

How is the net salary calculated?

By order of the Ministry of Finance, the net monthly income includes pensions, salaries and other remunerations during the same period (overtime allowances, bonuses, allowances for night work, work on weekends and public holidays). The calculation of the net annual income is the following: the net monthly income is multiplied by 12, plus all the bonuses for Christmas, Easter and holidays for those who receive such additional remuneration.

Additional incomes

If the worker receives bonuses, except those for extra hours, this amount is not added to the monthly income, but is added to the net annual income. In this case, the additional tax due will be charged for the month in which the amount was received. The tax will be reduced by 1.5%, and the remainder will be charged on an annual basis.

Examples

The Ministry of Finance gave specific examples to make the amount of reductions for workers and retirees clear.

- If the worker receives a net monthly income of 1,650 euro (one and the same for all the months of 2013), the net annual income will be 12 x 1,650 = 19,800 euro.

Of this amount, 201.68 euro will be deducted as follows:

Annual Tax: 4,356 - 2,100 = 2,256 euro

Tax reduction for additional deductions: 2,256 х 1.5%= 33.84 euro

The tax to be deducted each month: 2,256 - 33.84 = 2,222.16 / 12 months = 185.18 euro

Solidarity contribution

Net annual income: 12 x 1,650 = 19,800 (1%)

Therefore: 1,650 x 1% = 16.50 euro

- If workers in the private sector receive, for example, a 1,650 euro net monthly income (constant for all months), Christmas bonuses in December amount to 1,650 euro, Easter bonuses in April amount to 825 euro, and holiday bonuses in July amount to 825 euro.

Net annual income: 14 x 1,650 = 23,100 euro

Annual Tax (based on the tax scale and deductions): 5,082 - 1,900 = 3,182 euro

Tax reduction for additional deductions: 3,182 x 1.5% = 47.73 euro

The tax to be deducted each month: 3,182 - 47,73=3,134.27/14 = 223.88 euro

The tax to be deducted for Christmas bonuses: 3,134.27/14= 223.88 euro