Picture: www.naftemporiki.gr

In 2012, the decline in real estate prices accelerated in most parts of the country. The cumulative decline has reached 26.3% since 2007. According to the National Bank, in parallel, there was a decline in sales of real estate, since interest in property investment has declined because of the recession and uncertainty in the economy. The collapse of selling prices of properties will affect their nominal value, following their update in March. The competent committee of the Ministry of Finance will submit its report to the political leadership of the Ministry by the end of February. It will describe changes in selling prices of properties across the country. Based on the report, the Ministry will determine the amount of tax assessments and, as promised by Finance Minister Yiannis Stournaras, in areas where selling prices are lower than tax assessments, these will be reduced. According to the memorandum, tax assessments should be aligned with market estimates. The last update of tax assessments was in March 2007 and, over the past six years, market prices have declined.

A new price drop

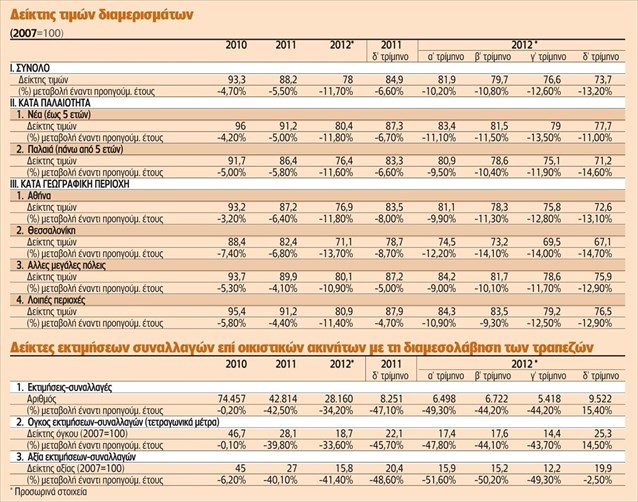

In the last quarter of 2012, real estate prices fell significantly and by a larger percentage compared both to previous quarters and previous years. According to data of the National Bank that were gathered from commercial banks, apartment prices decreased by an average of 13.2% in the fourth quarter of 2012 compared to the corresponding quarter of 2011. In the third quarter of 2012, the decrease was 12.6%, in the second quarter - 10.8%, and in the first quarter - 6.6%.

In general, in 2012, the average price of apartments fell by 11.7% compared to 2011, and in 2011 it fell by 5.5%, while in 2010 it fell by 4.7% compared to the previous year. The index of prices set by the National Bank, based on 2007, when the index was 100, was 73.7 units in the last quarter of 2012 - an overall decline of 26.3% in the last five years. The decline in prices of old apartments in comparison to newly built ones was more rapid. In the third quarter of 2012, prices of new apartments (up to five years) decreased by 11% compared to the corresponding period in 2011, while old apartment prices fell by 14.6%. In general, in 2012, the price reduction was 11.8% for new apartments versus 5% for 2011, and for old apartments it was 11.6% in 2012, versus 5.8% in 2011.

Athens-Thessaloniki

In Athens, apartment prices fell by 11.8% in 2012, 6.4% in 2011, and 3.2% in 2010. Compared to 2007, housing prices fell by 27.4%. In Thessaloniki, the reduction was even greater. In 2012, prices fell by 23.7%, in 2011 - 6.8%, and -7.4% in 2010. In general, since 2007, house prices have fallen by 32.9%.

In other big cities prices fell by 10.9% in 2012, 4.1% in 2011, and 5.3% in 2010. Since 2007, total losses have reached 24.1%.

In other parts of the country, prices of apartments fell by 11.4% in 2012, 4.4% in 2011 and 5.8% in 2010.

According to an analysis of data by geographic area, prices of apartments in the fourth quarter of 2012 were lower compared to the fourth quarter of 2011 - 13.1% in Athens, 14.7% in Thessaloniki, and 12.9 % in other big cities.

Shrinking trade

Last year, real estate transactions recorded a decline as a whole in the last quarter of 2012. These included transactions brokered by banks for various reasons (purchase financing, mortgage insurance, transfer of debts of customers from one bank to another, etc.). In particular, the number of evaluations and transactions carried out in the fourth quarter of 2012 with the cooperation of banks was 9,500 compared to 5,400 in the third quarter, 6,500 in the second quarter and 6,500 in the first quarter.

The National Bank explained that the increase in the number of evaluations over the last three months of 2012 was a result of the decision of certain large commercial banks to re-evaluate the majority of the properties that are subject to financing or insurance. Throughout 2012, the number of evaluations was 28,200 - 34.2% less than in 2011, when it was 42,800 and in 2011 evaluations decreased by 42.5% compared to 2010.

The volume of homes that were subject to evaluations and sales (based on their area in square metres) increased by 14.5% in the fourth quarter of 2012 compared to the same quarter of 2011. In 2012, the volume decreased at an average annual rate of 33.6% compared to the even greater reduction of 39.8% in 2011. Property values, assessed through banks, declined by 2.5% in the last quarter of 2012 compared to the corresponding period of 2011.