photos www.iefimerida.gr

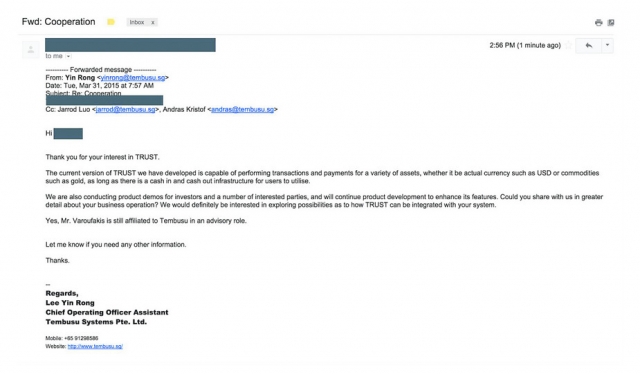

According to a Proto Thema publication, Finance Minister Yannis Varoufakis is a consultant in a rather controversial Singaporean company that launched the digital currency Βitcoins. This is clear from an e-mail, which the newspaper has obtained. In it, one of the managers of Tembusu Systems states that Varoufakis retained his post at least until 31 March 2015, i.e. almost two months after he took over as minister.

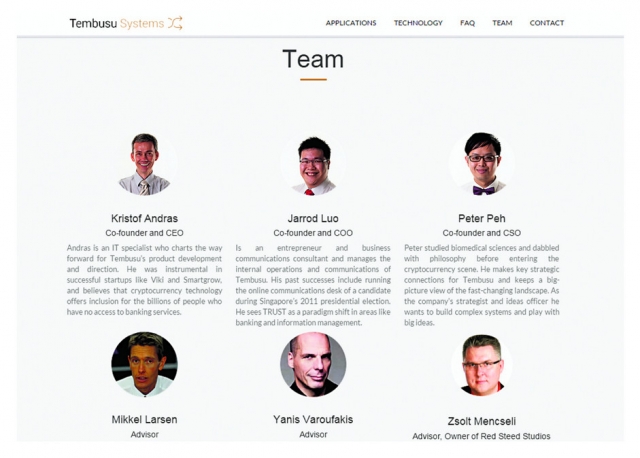

Even today, Varoufakis’ name features on the page of the company http://www.tembusu.sg/. His profile is among the company’s line-up as an advisor.

The fact that the minister of finance is among those who inspired and supported an extreme and innovative method for financial transactions, raises legitimate questions. If one traces the publications about Bitcoin, and the whole philosophy of digital currency transactions, one can conclude that this method may possibly be the answer to the debt and liquidity crisis currently pestering Greece.

Therefore, one may wonder why Greece still has a debt problem, and why its financial predicament has not been aleviated if the head of its financial crew is a person who knows a simple solution to this complex issue.

The experience of the finance minister in the creation of digital markets (e.g. the TRUST platform) could open a new chapter in the management of Greek debt. Because many believe digital money can offer a way out.

Anyway, if someone has the knowhow at all, it must be Varoufakis. Apart from all else, he seems to have a standby team of cryptocurrency and digital economy experts available, at the ready to ‘salvage’ the Greek economy if and when requested.

The story began in November 2014 when the Singaporean firm Tembusu recruited to its advisory team the prominent university professor, Yanis Varoufakis. Tembusu founders say they offered the job to Varoufakis because they appreciated his exceptional work in the planning of a "digital economy" for Valve Corporation, an online video game company.

Up till then, Tembusu had distinguished itself by the launch of Bitcoin, and by the fact that it was the first that dared to install Bitcoin ATMs in Singapore. The company was bracing itself to leap a level up, to the "new era of digital trading platforms", i.e. "the day after Bitcoin".

Varoufakis accepted the invitation and, according to the company itself, was involved as an advisor months after becoming a minister, despite the obvious inconsistency of his new post with his employment in a private company. According to market experts, such positions are rewarded with stock options. That is, instead of fees, advisors receive equity shares. Thus, if the latter were to increase in value, advisors should strive to strengthen the company’s performance.

A 24 February Guardian publication penned by Paul Mason, out a month after the Greek elections, recalls a not-so-old story with Varoufakis and Bitcoin digital money as the key characters. At the beginning, Mason gives a brush-up on digital money called by their worshippers (Varoufakis among them) "a brave attempt to create a currency away from state or central bank control, in fact far from the control of any central authority." The author recalls that in early 2014, shortly before starting to collaborate with Tembusu, Varoufakis described in detail how digital money could be used to boost demand through the so called ‘quantitative easing’.

Back then, Bitcoin was already seen as obsolete yet also hazardous because it had become the target of hackers. Besides, digital currency stood accused of having turned into a veritable money laundering tool. But the virtual currency of the new generation, which was already being hammered out by a group of economists and businessmen, among whom the future Greek finance minister, would be different.

What Varoufakis stated publicly back then was that if Greece used digital money, rated 1 to 1 with the euro, it could solve its liquidity problem. For this to happen, however, the digital currency should be issued by the state, complete with a method for converting into ‘tangible’ material goods. E.g., if one kept a stash of digital money for two years, then one could cash in on it by, say, getting a tax relief. Which is why Varoufakis labelled this money "the future tax currency."

Varoufakis also argued that if the government released a digital currency parallel with the euro, and forced the banks and companies to use it, this would increase the money supply, irrespective of ECB policies.

Varoufakis’ response

On Saturday evening, the ministry of finance responded to the publication. The minister maintained that he had discussed digital money and electronic payment systems in many publications and interviews. "This is research I was involved in before entering politics," says Varoufakis.

As far as Tembusu is conserned, Varifakis said: "They contacted me in 2013 and asked for my advice, as its creators (young, talented technocrats) had read my articles in this area. As the subject interested me, from the US, where I was working, I provided them with a thorough consulting paper. In it, I outlined a comprehensive framework of electronic payment systems, which I named TRUST."