Only 24 hours after the European Central Bank increased by 1.1 billion euro the limit of the Emergency Liquidity Assistance (ELA) that provides financing to the Greek financial institutions, the banking system required a larger influx of liquidity to overcome capital flight.

Official data show that deposits worth over 1 billion euro were withdrawn from banks on Thursday alone. Although the Bank of Greece has not confirmed the information that it has submitted a request to increase the ELA limit, other sources state that the Governing Council of the European Central Bank will discuss the issue at today's teleconference meeting.

Anyway, the tense situation in the Greek banking sector has further exacerbated due to the publication of Reuters, according to which, during last night's meeting of the Eurogroup, member of the Governing Council of the European Central Bank Benoit Coeur expressed doubts that Greek banks would open this coming Monday. The European Central Bank did not confirm the information and Greek Minister of Finance Yanis Varoufakis firmly denied it. Later, however, Financial Times reporter Peter Spiegel said that two senior European officials who participated in the meeting of the Eurogroup had confirmed the information.

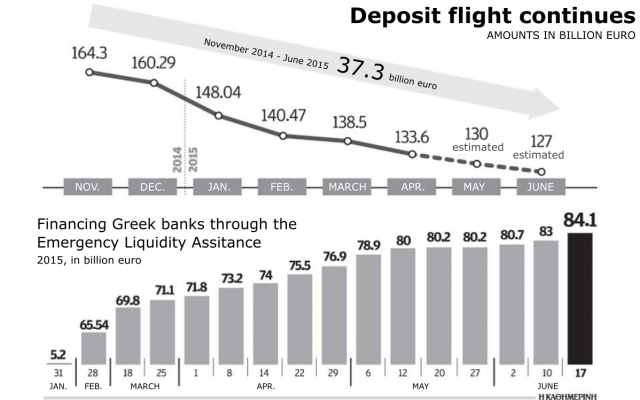

The fears due to the extension of negotiations between Athens and its creditors and the continuous statements by the members of the Greek cabinet in favour of the rupture scenario and even of Greece's exit from the euro zone are the reason for the continued deposit flight from Greek banks. More than 3 billion euro was withdrawn since the beginning of the week until yesterday and banks are now struggling to meet the requirements of Greek depositors. Therefore, it is expected that only a day after the increase of the ELA limit by 1.1 billion euro, the European Central Bank today will discuss the emergency request to provide additional liquidity to Greek banks.

According to sources referred to by the Greek daily Kathimerini, the Bank of Greece will request additional funding to the amount of 3.5 billion euro. Its senior representatives believe that the European Central Bank will approve the allocation of the amount, stressing that it will continue to support the Greek banking system while there is a possibility for Greece coming to agreement with creditors and repaying its obligations. In their words, a possible refusal by the European Central Bank amidst the negative climate and public concern will make it very difficult for Greek banks to respond to the withdrawal of deposits.

Yesterday the Greek systemic banks had a meeting with Deputy Prime Minister and coordinator of economic policy of the Greek government Yiannis Dragasakis and asked him to inform them on the progress of negotiations with creditors. He said he was optimistic about their successful conclusion, pointing out that the differences between the two sides were small and they would soon be able to reach an agreement. The meeting also discussed the state of bank liquidity. According to sources, the bank representatives stressed before the Deputy Prime Minister that the insistent statements in favour of a rupture in negotiations and conflict with creditors were worsening the climate and enhancing the liquidity outflow.

Meanwhile, commenting on the press reports, the government sources defined the facts as "a plan of a pointless and artificial capital flight in order to cause confusion and economic destabilization." The same sources said, "Greece cannot be blackmailed." "The people know who is bleeding to protect his interests and who is playing petty games. The efforts of these circles will fail. They will collapse against the composure, sobriety and determination of both the government and the people."

It is worth noting that since December 2014, when the early parliamentary elections were announced, deposits in Greek banks have fallen by about 36 billion euro.

Greece’s possible exit from the euro zone would cause a shortage of basic goods, medicines and fuel. The Greek government seems to be preparing for this possibility, since, according to a publication in the newspaper Ta Nea, Minister of Development and Energy Panagiotis Lafazanis had asked the Greek oil company ELPE to draw up an emergency action plan in order to cover fuel needs in the country in the case of Grexit. In statements to the media, ELPE representatives said that the stocks of Greece were sufficient for the next 6 months and that this period could be extended by another three months if required. The first stage of the plan provides for the use of military fuel supplies that are sufficient to cover the needs for three months. In the second stage, the fuel supplies in the market will come from the already signed agreements for future deliveries. To ensure the needs for another three months, the plan provides for the purchase of additional quantities from abroad that will be paid through the products processed at the refineries of ELPE.

The emergency plan under which the state restricts the use of vehicles of certain categories in order to limit fuel consumption will also come into effect.